Union Finance Minister Nirmala Sitharaman is scheduled to present the full budget tomorrow (July 23), Indian stock indices ended the day with losses. Markets as well as investors are keenly watching to see how popular the Modi 3.0 Cabinet, which has come to power without a single majority, can present a budget.

February’s interim budget did not make any major announcements or significant changes in tax rates. Therefore, the country is listening to the budget tomorrow with high expectations. The Sensex, which was volatile at the start, later returned to gains, but ended in losses.

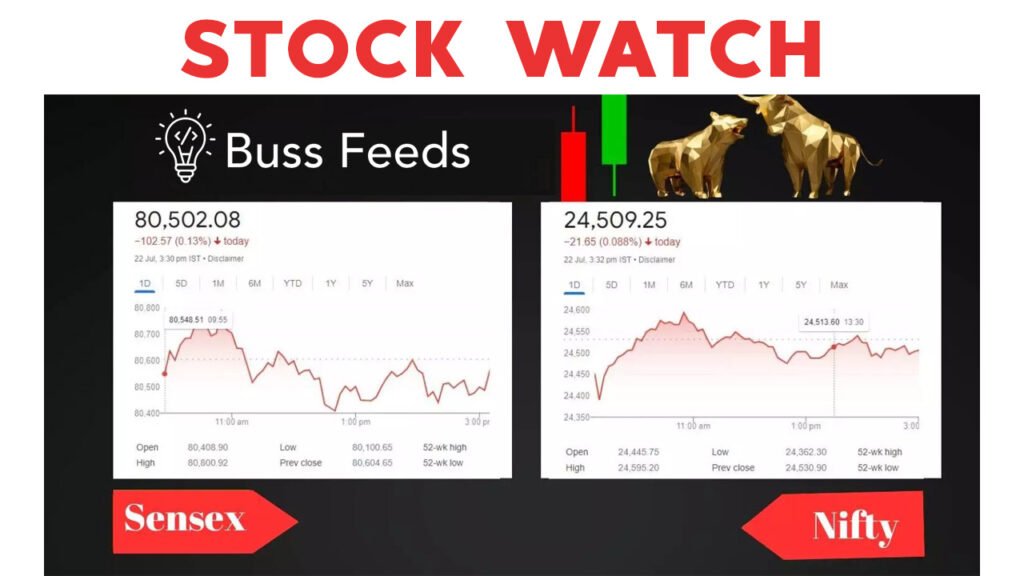

Indices lost for the second consecutive day as investors took profit and remained cautious ahead of the Budget. Sensex closed down 103 points at 80,502.08 and Nifty closed down 22 points at 24,509.25.

At the same time, the smallcap and midcap sectors performed well. The Nifty Midcap Index gained 1.28 percent and the Small Cap Index gained 0.90 percent.

The Volatility Index, a measure of volatility in the stock market, is at a six-week high of 15.54.

Ahead of the budget presentation tomorrow, Finance Minister Nirmala Sitharaman held an economic survey in Parliament. The expected growth for the current year is between six and a half to seven percent. The survey also expressed hope that inflation will remain at a manageable level of 4.5 percent.

Observers point out that domestic and foreign investors are cautiously watching whether the long-term capital gains tax will be changed in the Union Budget.

Performance of various indices

Among the broader market, Nifty Auto gained 1.15 percent while Metals, Pharma and Healthcare gained more than 1 percent. Bank, Financial Services and Consumer Durables also gained. FMCG, IT, Media, Realty and Oil & Gas indices were the losers today.

In Nifty today, 28 stocks were gainers and 22 stocks were losers.

Out of 4,152 shares traded on BSE today, 2,190 shares ended in losses. 1,822 shares gained. 140 shares remain unchanged.

174 stocks touched their 52-week highs today while 42 stocks hit their lows. 343 shares are in the upper circuit today. 323 shares are in lower circuit.

Stock market giants Reliance Industries and Wipro led the indices to disappoint today. ITC and Kotak Mahindra Bank were also the top losers on the Sensex today. HDFC Bank, Infosys, and mahindra. Mahindra supported the indices today.

The rise and fall of stocks

The Indian Hotels Company stock rose 7.28 percent today to become the top gainer on the Nifty. Fact came second with a gain of 6.36 percent. Fertilizer stocks rose today on indications that the government may spend more to boost consumption in the rural market through key schemes.

National Fertilizers and Rashtriya Chemicals and Fertilizers rose as much as 13 percent. The budget is expected to contain proposals to consolidate fertilizer subsidies and increase investments in agricultural research. Proposals were also placed before the Finance Minister that all subsidies in the agriculture sector should be integrated in the Direct Benefit Transfer Plan.

Other gainers in Nifty 200 include PI Industries, Oberoi Realty and Hindustan Aeronautics.

Shares of IT company Wipro suffered after its first quarter results fell short of expectations. The results were announced after market hours on Friday. The stock price fell as much as 11.5 percent in today’s trading session.

Wipro’s constant currency revenue fell for the sixth consecutive quarter, which hurt the stock. The stock lost 9.31 percent in late trade. Reliance Industries shares were the second among the Nifty 200 losers. A 5 percent decline in profit in the first quarter missed market expectations. Brokerage firms Jefferies and Nuwama cut their target price on the stock due to weakness in the stock made.

Kotak Mahindra Bank shares tumbled around 3 per cent in the first quarter, despite higher profits, but a contraction in net interest income margin. BSE and Zee Entertainment were the other major losers in the Nifty 200.

Bright in Kerala shares

Muthoot Capital Services has shown more progress among Kerala companies today. The share price rose more than eight percent. PSU fertilizer company FACT (Fertilizers and Chemicals Travancore) and PSU port company Cochin Shipyard were two other top gainers. FACT stocks have been driven by indications that there may be proposals in the budget that will be beneficial to fertilizer companies. The share price rose by around six and a half percent. The fact that there will be special emphasis on the defense sector in the budget has also benefited shipping companies including Cochin Shipyard. Cochin Shipyard share price is in the upper circuit of five percent.

Patspin, Rabfila, Stell Holdings, Eastern Trades, Aspinwall & Company, Astor D.M. Healthcare and unimarine exports also performed well.

Today, PTI Industries is leading in the loss count. Kalyan Jewellers, Kerala Ayurveda, Manappuram Finance, Muthoot Finance, Wonderla etc. also closed with losses.

2 Comments

Pingback: Changes In Capital Gains Tax What are the new changes? Everything you need to know - Buss Feeds

Pingback: Balancing Business Studies with Work: just keep these things in mind - Buss Feeds